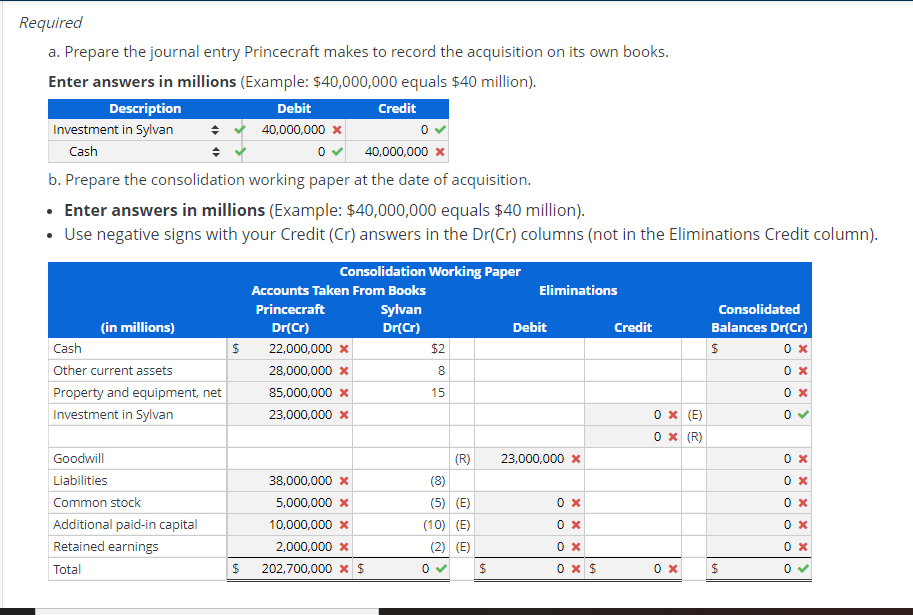

Consolidation Journal Entry at the Date of Acquisition

But they arent real. Note date of acquisition and date of consolidation Process consolidation adjusting entries in worksheet.

Learn more about the various types of mergers and amalgamations.

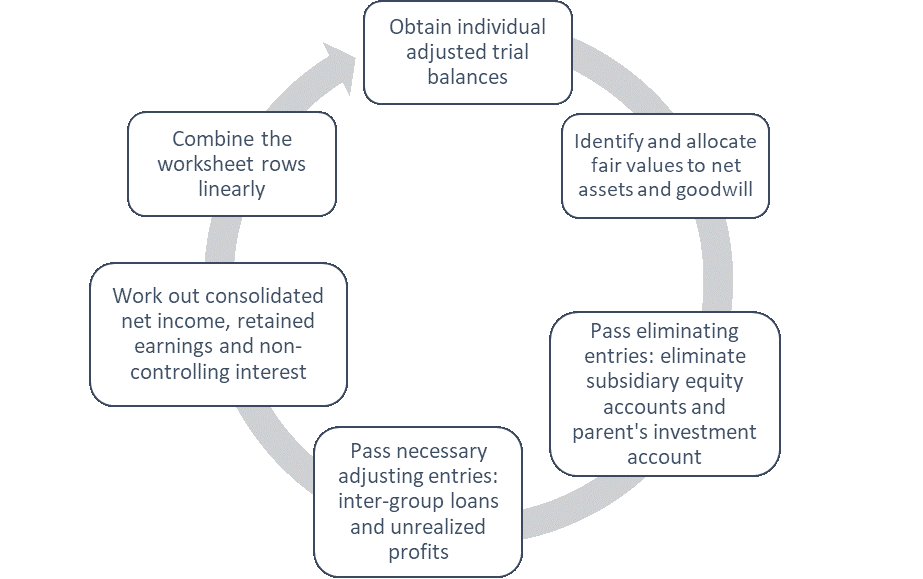

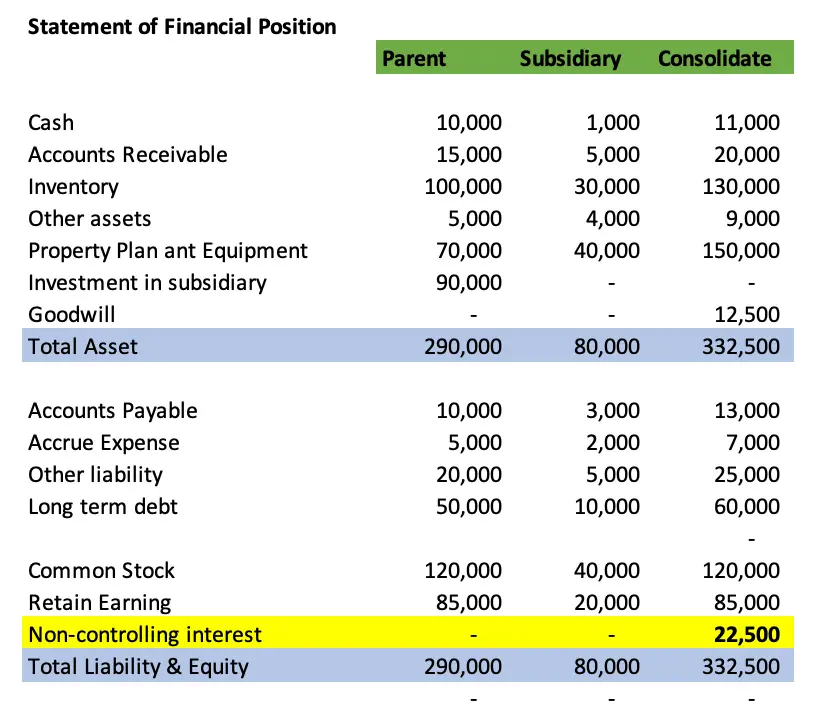

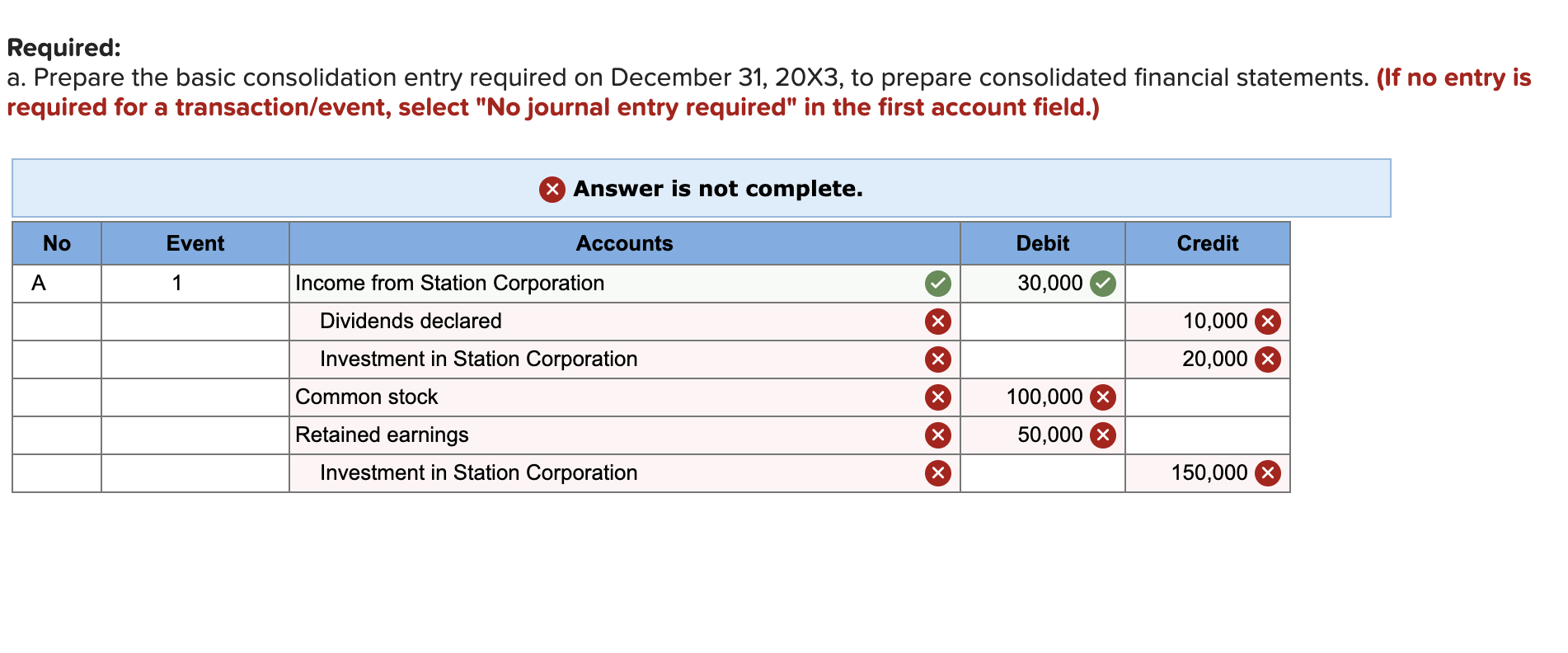

. Consolidated sheets are a picture that you paint using the palette of the parent and subs. Acquisition analysis - Conducted at acquisition date - To recognise identifiable assets and liabilities of the subsidiary at fair value - To determine if there is any Goodwill or Gain on Bargain purchase - Comparing cost of acquisition with fair value of identifiable net assets. Consolidation As Of The Date Of Acquisition 4-2 Consolidation-Date of Acquisition Consolidated statements bring together the operating results and financial position of two or more separate legal entities into a single set of statements for the economic entity as a whole.

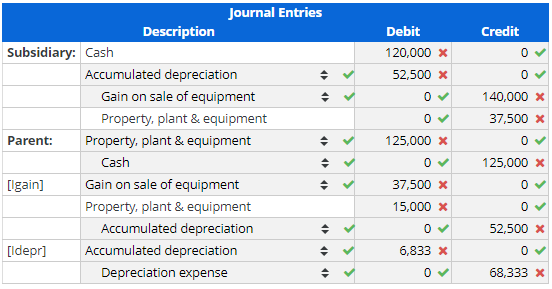

- The entry along with the basic consolidation entry will fully eliminate the investment account. So if you do it again at year end you essentially have to re-make them from scratch. Raymond Tan Created Date.

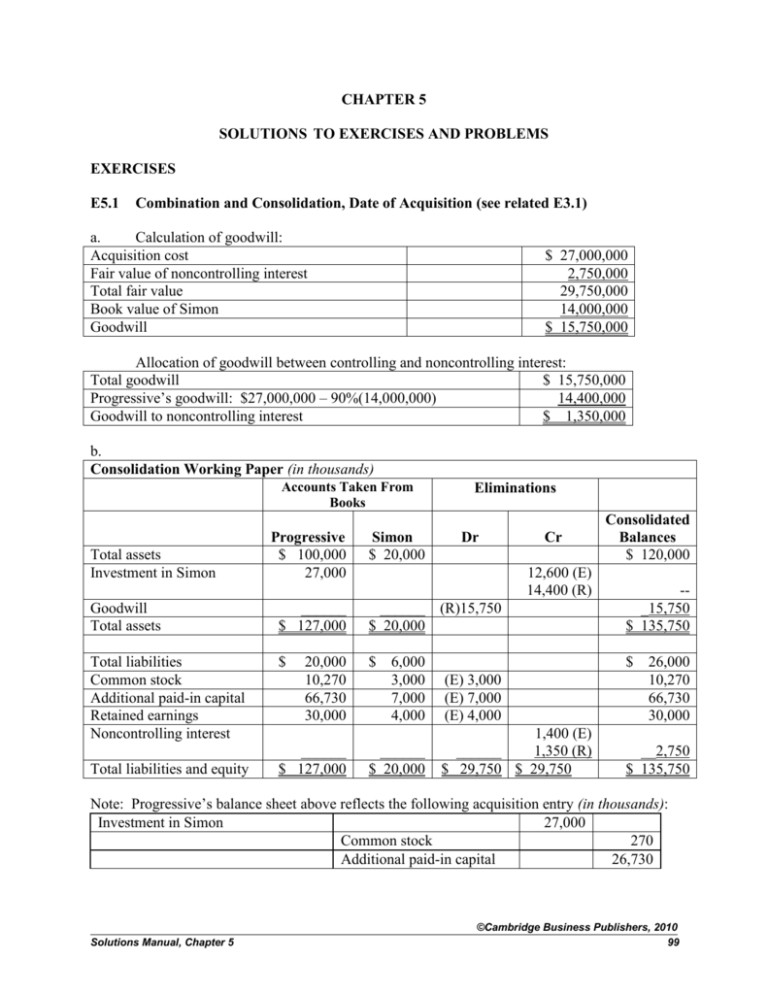

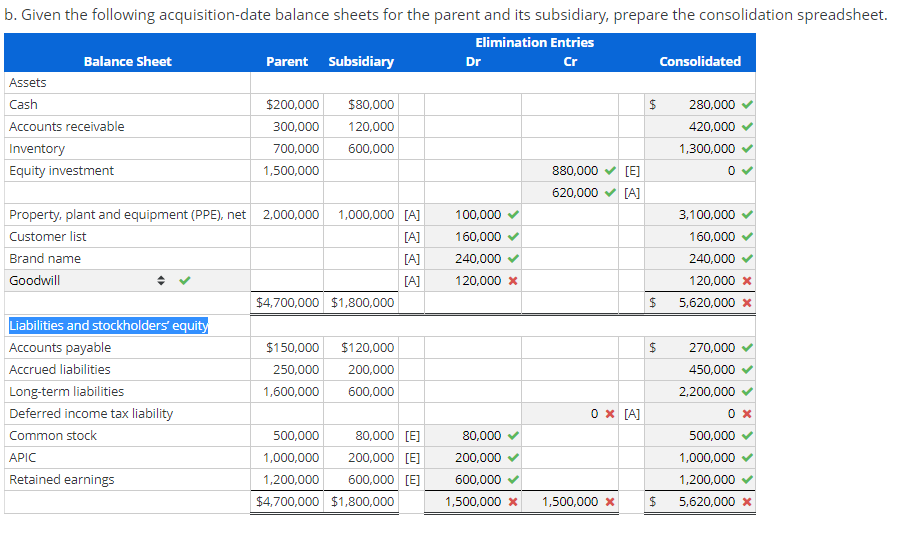

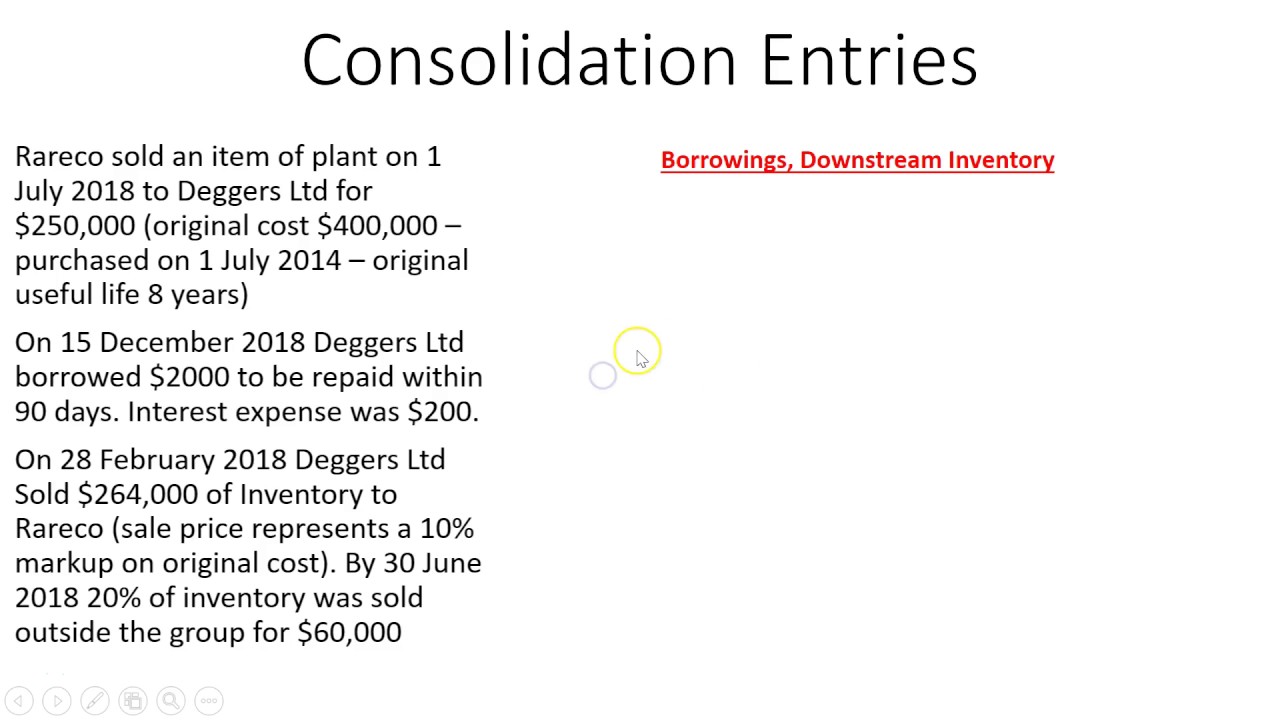

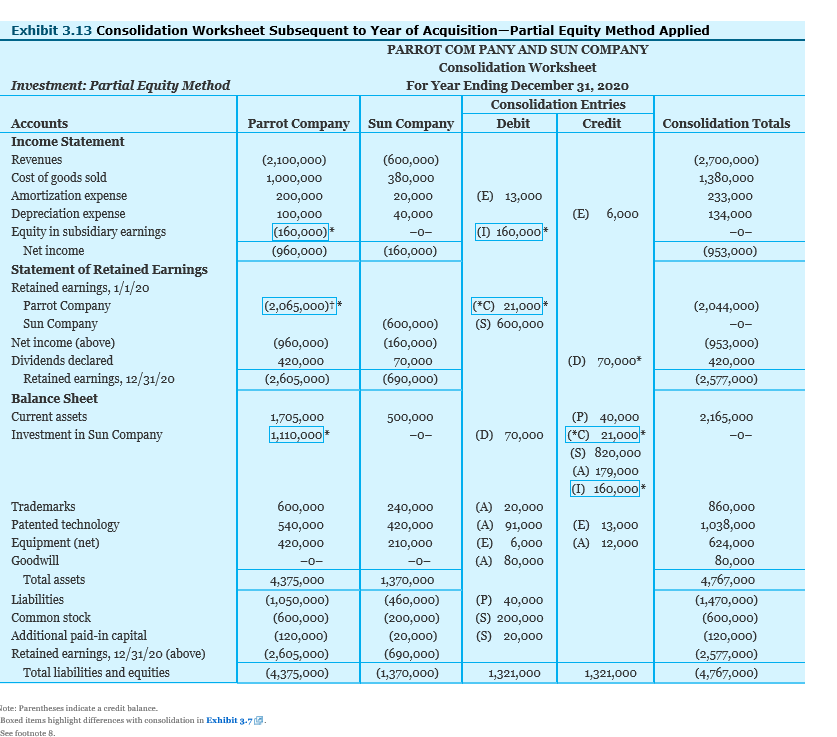

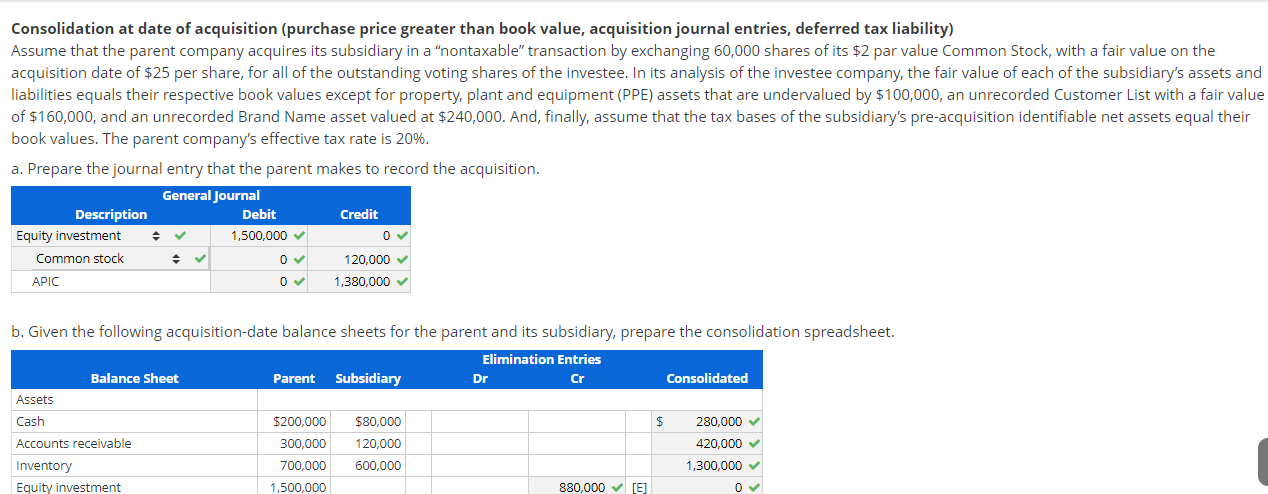

3 new consolidation journal entries subsequent to the date of acquisition C changes D depreciation I intercompany. TOPIC 4 CONSOLIDATION. Consolidation at date of acquisition purchase price greater than book value acquisition journal entries deferred tax liability assume that the parent company acquires its subsidiary in a nontaxable transaction by exchanging 60000 shares of its 2 par value common stock with a fair value on the acquisition date of 25 per share for all of.

Guide to Business Combinations. Likewise when the company acquires another company to become its subsidiary it can make the journal entry for goodwill on acquisition in order to present such. Sometimes the company may decide to purchase another business for various reasons such as acquiring the supplier eliminating the competitor or simply trying to expand the scope of its business etc.

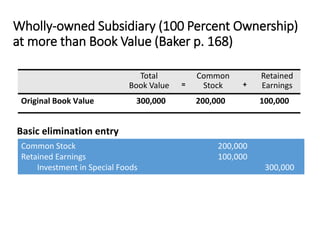

Pre-acquisition elimination entry The first step in preparing consolidated financial statements is to deal with the pre-acquisition elimination journal entry as at the acquisition date. In the case of Queen Bee Limited DBL set out in the Appendix in order to calculate the amount of total consideration candidates should be aware. A bargain acquisition is said to occur if the total fair value of the investee company is _____ than the acquisition-date amounts of the identifiable assets acquired and the liabilities assumed.

Consolidation at date of acquisition purchase price greater than book value acquisition journal entries Assume the parent company acquires its subsidiary by exchanging 50000 shares of its 1 par value Common Stock with a fair value on the acquisition date of 30 per share for all of the outstanding voting shares of the investee. Our consolidation worksheets help you visualise the group consolidation process making it easier to understand the consolidation process. Consolidated worksheet adjusting entries Eliminating parents investment against equity acquired in subsidiary Dr Subsidiarys total equity balance at acquisition date Cr Parents investment in subsidiary o E.

So if you produce consolidated sheets at acquisition youll make a bunch of entries. Journal Entry in Parent. If the subsidiarys equity consists of.

To accomplish this the consolidation process. The consolidation method works by reporting the subsidiarys balances in a combined statement along with the parent companys balances hence consolidated. Investment in Subsidiary 30000000 Indirect Expenses 1200000 Cash 31200000 to record acquisition of Subsidiary Co.

Acquisition date and subsequently periods Consolidation process 1. Consolidation at date of acquisition purchase price greater than book value acquisition journal entries Assume that the parent company acquires its subsidiary by exchanging 84000 shares of its 2 par value Common Stock with a fair value on the acquisition date of 45 per share for all of the outstanding voting shares of the investee. On the date of acquisition if the fair value of a subsidiary is more than the fair value of its net identifiable assets the excess value is referred to as _____.

The Guide to Business Combinations comes free with the Guide to Consolidation Journal Entries this covers areas including. An opposite journal entry to avoid double counting the net assets of a subsidiarys pre-acquisition equity o Dr Share capital. Hi jan basically you consolidate balance sheet in full and profit or loss only since the acquisition date until the end of the reporting period.

The noncontrolling interest is allocated 20 percent of the excess fair-value allocation from the customer base. Establishment of a new entity. Advanced Financial Accounting Advanced Financial Accounting Advanced Financial.

The consolidation worksheet entries are essentially the same as if Art had acquired its entire 80 percent ownership on January 1 2011. Under the consolidation method a parent company combines its own revenue with 100 of the revenue of the subsidiary. Profit or loss items incurred from the beginning of the period til the acquisition date are considered pre-acquisition and.

Equity method journal entry the parent would record upon receipt of. View CONSOLIDATION AT DATE OF ACQUISITION_BADVAC1X_OnlineGlimpseNUJPIApptx from MKTG-SHU 0063 at New York University. In the case of wholly owned subsidiary the acquirer parent shall recognize goodwill as of the acquisition date in a business combination measured as the excess of the consideration transferred at fair value over the net of the identifiable assets acquired and the liabilities assumed and the contingent liabilities based on acquisition fair value the equity of the.

Consolidation at date of acquisition purchase price greater than book value acquisition journal entries Assume that the parent company acquires its subsidiary by exchanging 50000 shares of its 1 par value Common Stock with a fair value on the acquisition date of 30 per share for all of the outstanding voting shares of the investee.

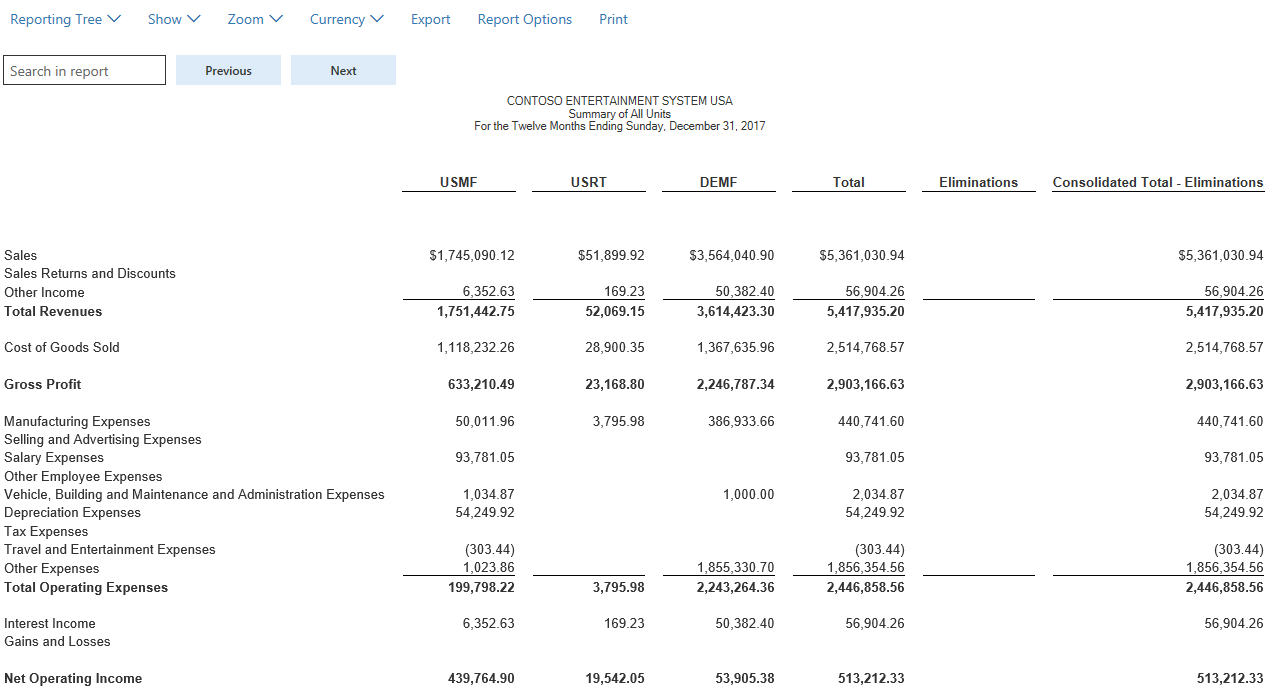

Generate Consolidated Financial Statements Finance Dynamics 365 Microsoft Docs

P5 3 Consolidation Eliminating Entries Date Of Acquisition

Solved Consolidation At Date Of Acquisition Purchase Price Chegg Com

Solved Consolidation Working Paper Simple Example Below Are Chegg Com

Investments Requiring Consolidation Principlesofaccounting Com

Consolidated Financial Statement At More Than Book Value

Consolidation Worksheet Steps Example

Consolidating Trial Balance Example Uses

Accounting For Business Combinations Non Controlling Interest Youtube

In Consolidation Worksheet Entry C We Adjust The Chegg Com

Consolidating Balance Sheet Example Uses

Solved Consolidation At Date Of Acquisition Purchase Price Chegg Com

Non Controlling Interest Nci Formula Example Accountinguide

Solved Prepare Consolidation Spreadsheet For Intercompany Chegg Com

The Consolidation Process Oracle General Ledger Users Guide

Solved E4 20 Basic Consolidation Worksheet Lo 4 5 Police Chegg Com

Comments

Post a Comment